Canstar Term Deposits

So you want to find the best way to maximise your money, who can blame you? A term deposit is a popular option to keep savings out of reach and to boost those dollars in the process. And, according to Canstar’s latest research, locking away the savings for longer than a year can often mean greater returns.

In the case of five-year term deposits, in 2017 you can get a maximum rate of 4.20% (up from 4.05% in 2016), according to Canstar’s database. This compares with a maximum rate of 2.85% for a three-month term deposit (down from 2.95% in 2016). When you compare maximum rates for the two different tenures, there’s a 1.35% difference, or 135 basis points. But before you are blinded by the dollar signs appearing in your eyes, it’s important to look at what having a term deposit entails. and whether you’re in a position to lock away your money at all.

Compare term deposits from over 14 providers with our free comparison service. Find the best interest rates and features for your next term deposit. The CANSTAR Term Deposit Award involves a sophisticated rating methodology, unique to CANSTAR that compares a shortlist of term deposits in Australia, enabling consumers to narrow their search to products that have been independently assessed and ranked. The Award aims to give recognition to the institutions who offer quality term deposit.

Comparing three-month term deposits with five-year term deposits:

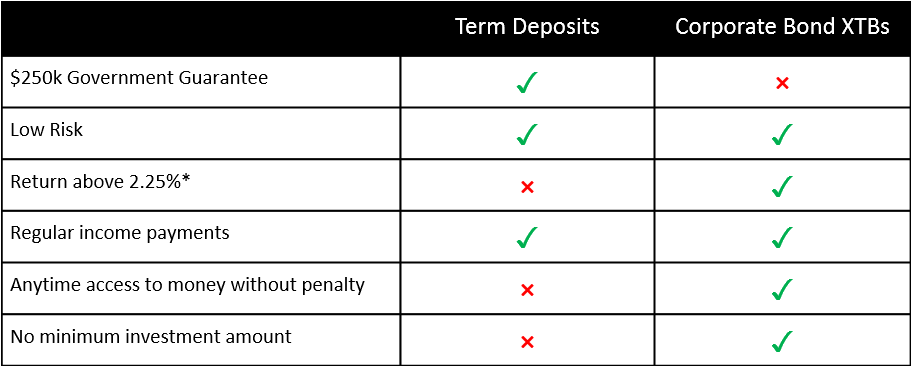

Award Winning Term Deposit. Australian Government Guarantee - Under the Financial Claims Scheme, deposits are protected up to a limit of $250,000 for each account holder at Judo Bank, for more information please visit www.fcs.gov.au.

Three-month term deposits

| 2016 | 2017 | Difference +/- | |

|---|---|---|---|

| Minimum | 2.50% | 2.40% | -0.1% |

| Maximum | 2.95% | 2.85% | -0.1% |

| Average | 2.79% | 2.63% | -0.16% |

Five-year term deposits:

| 2016 | 2017 | Difference +/- | |

|---|---|---|---|

| Minimum | 3.50% | 3.30% | -0.2% |

| Maximum | 4.05% | 4.20% | +0.15% |

| Average | 3.85% | 3.97% | +0.12% |

Term Deposit Rates New Zealand: How does the length affect your finances?

Once you have invested money in a term deposit, it’s in there for the entire length of the term selected – anything from three months to five years. Minimum, maximum and average rates have decreased for all nine of the three-month and six-month term deposits rated, according to Canstar’s research. In the case of one-year term deposits, the maximum rate has increased by 0.15%, but the minimum and average rates have decreased. The news is more positive in the longer term deposits. For two and three-year term deposits, minimum, maximum and average rates have increased over the past year. And, across all five-year term deposits rated, only the minimum rate has decreased (by 0.2%) but the maximum and average rates have increased.

The chance to get a high interest rate on your term deposit is no doubt appealing, but it’s important to think beyond any possible returns and to consider your personal financial situation. Ask yourself when you will need access to your money. For example, are there any big events coming up? Sure, you might think you have budgeted enough money for that upcoming holiday or your best friend’s wedding, but have you also got a bit of leeway in that budget? Five years is a long time to lock away your money, so do not take the term deposit length lightly. CANSTAR has looked at how term deposit rates have fared over the past year; you can read more on that here.

Are there any other reasons why rates increase with longer term deposits?

Banks don’t just pluck a term deposit rate out of thin air; there is a basis for decisions around increasing or decreasing rates. Providers set their term deposit rates around what they anticipate will happen in the wider economy and will sometimes pay a small premium for longer-termed deposits, so they can ensure they have those funds on hand. After all, they need funds available for lending to customers in the future.

Choosing a term deposit length, what else do you have to consider?

Even when you do make a financial plan, sometimes life gets in the way, things crop up and you suddenly need access to your funds. While it is possible to break your term deposit, you’ll generally pay a penalty for doing so. Researching early exit penalties is an essential part of your term deposit homework. According to the Banking Ombudsman scheme, if providers agree to let you break the term deposit, you’ll likely lose the interest that attracted you to the savings product in the first place. The provider might also try to get back any interest that it paid out during the length of the deposit. The reduction in interest may depend on how much money you put into the account, the current interest rates and the length of the term. And before committing to a term deposit, make sure you do a thorough comparison of what is available on the market, comparing interest rates, but also the features they offer. Check out Canstar’s latest ratings results, to find out what’s on offer in the term deposits market.

What is a term deposit and how does it work?

A term deposit is a deposit held at a financial institution, bank, building society or credit union for a fixed amount of time, known as a term. When the money is deposited, the customer understands that the money is there for the pre-determined period which usually ranges from 1 month to 5 years. Typically, the money can only be withdrawn at the end of the period, however it can be accessed earlier but penalties apply. This is usually partial or full forfeiture of the interest rate the term deposit would have earned.

Term deposits are popular with investors who prefer the safety of this type of ‘money minder’, as opposed to the fluctuations of, say, the share market. Many investors also use term deposits as a part of their investment mix.

How do I apply for a term deposit?

To apply for a term deposit you follow much the same process as you would when you apply for a normal bank account. It’s even easier if you apply for a New Zealand term deposit at the same institution you already bank with. Once you have earmarked the amount of money you want to invest and the interest rate you are locking in, it is simply a matter of filling out a form.

What if I want to break my term deposit?

If you want to break your term deposit, you need to first understand you could be heading for an uphill battle with your bank. The Banking Ombudsman of New Zealand points out that financial service providers are not legally required to allow customers to access their funds before the fixed term. Some providers offer a “cooling off” period, when you first open a term deposit account – a period of time where you can cancel your tern deposit and have your principal repaid – but without interest. If you can demonstrate you are in hardship, you might be able to withdraw your funds without giving notice.

Canstar Term Deposit Calculator

Pros and cons of term deposits include:

| PROS | CONS |

|---|---|

| You receive a specified interest rate at the end of the term, regardless of whether rates drop in the meantime | Online savings accounts sometimes offer higher interest rates. |

| Savings are locked away, preventing the temptation to spend it all. | Your money is not available for use at any time. You pay a penalty if you need to withdraw your money early. |

| Low-risk investment – less volatility in the term deposit market. | The real rate of return is not as good as it seems. To calculate your actual profit from a term deposit, subtract the current inflation rate from the interest rate paid. For example, if inflation was running at 1% and your term deposit was paying 3%; your “real” rate of return is 2% |

New Zealand term deposits – learn the market rates

Before you agree to open up a term deposit account, it pays to know the rates financial providers are offering, so you can see where your money will have the best chance at growing.

Read the Investment Statement

As with all financial products, it’s imperative you read the Investment Statement so you know exactly where you stand on a number of issues. For example, it’s important to find out whether the provider offers a cooling off period. Even if you have previously taken out a term deposit with the same bank, make sure you still read the document, as conditions can change and you don’t want to be caught out.

Pay particular attention to Maturity conditions, Prepayment penalties and, of course, any fees. Note that the overall return on investment will be affected by any fees you pay, whether at setup or at maturity.

Canstar Term Deposits Means

If you think there is a chance you might need to break your term deposit early, then you might want to choose a shorter term, or to explore other options, such as a savings account.

Canstar Term Deposits 2020

Enjoy reading this article?

Canstar Term Deposit Rates 6 Months

Sign up to receive more news like this straight to your inbox.

By subscribing you agree to the Canstar Privacy Policy