Capital One Direct Deposit

- Capital One Direct Deposit Form

- Capital One Direct Deposit Information

- Capital One Direct Deposit Routing Number

- Capital One Money Account Direct Deposit

- Capital One Direct Banking

- Capital One Direct Deposit Form

Did you know that Capital One launched a brand new online savings account called 360 Performance Savings?

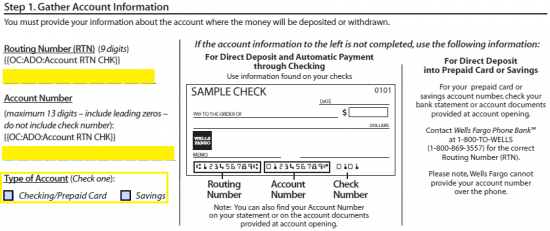

- Direct Deposit Information Form Information you'll need to provide to your employer to begin direct deposit to your Capital One Banking account. Download Direct Deposit Form (616KB PDF) Account Owner and Beneficiary Change Form Authorizes Capital One to revise account owner and/or beneficiary elections for an open account.

- Jul 30, 2015 How Direct Deposit Works. On the face of it, direct deposit is straightforward. All you have to do is set up a direct deposit once with the payer, and then the recurring payment appears in your account every time the payer initiates one. Everything else happens behind the scenes. Let’s take your employer’s payroll as an example.

I sure didn’t!

Unfortunately, it’s not a particularly exciting new account.

Call Capital One at 877-383-4802 and verify Login to your Capital One online account, they should show your account number on your statements The spot for your account number on a Capital One Deposit Slip. Double check the account number to make sure your money goes into your account. Cap1 doesn’t show outside deposits as pending for me. If I deposit a check my self it’ll show as pending. But, never direct deposits. In the same vein, I don’t ever have checks or direct deposits clear midday. It’s always over night; 12am-3am for me. I’ve noticed people talking about checking account constantly. Direct Deposit Information Form This product is offered by Capital One Bank (USA), N.A., and Capital One, N.A., members FDIC. © 2011 Capital One. Capital One is a federally registered service mark.

I have a few accounts with Capital One Bank but they all were legacy ING Direct accounts. Capital One acquired ING Direct back in 2012 and I just kept going along with it. I was tempted to close them when I went through a big personal finance simplification phase, but I continued to use one as a bank account firewall with PayPal. It served a purpose, paid a competitive interest rate, so I left it alone.

When Capital One acquired ING Direct, all existing ING Direct accounts were converted to 360 Checking and 360 Savings accounts. For years, nothing substantial else changed.

But now that Capital One has a new banking product, it’s time to pay a little bit more attention.

What is Capital One 360 Performance Savings?

It’s Capital One’s new name for their high-yield, no-fee online savings account. You get an interest rate of 0.40% APY with no minimums. Your funds are FDIC insured up to $250,000, there’s a mobile app, and you can open it online in just a few minutes. It’s a pretty run of the mill online savings account.

When Capital One started offering this “new” type of account, they took away their 360 Savings Accounts and 360 Money Market Accounts. It’s now Performance Savings only.

If you’re an existing Capital One 360 Savings customer, it’s pretty much the same as before except you get a higher interest rate with the new account type.

Money market accounts have been falling out of favor in the last decade or so. In the past, they were useful because you could earn a higher interest rate and still have more than six transactions/transfers per month. Nowadays, with online banking and credit cards, there really isn’t a useful place for your traditional money market account. It’s no surprise that Capital One did away with it.

How to Convert Your Account from 360 Savings to Performance Savings

There doesn’t appear to be a single button you press to convert an existing 360 Savings Account into a Performance Savings account.

You will have open a new Performance Savings account, transfer all of your funds from the 360 Savings to the Performance Savings, and then close your 360 Savings account.

Fortunately, opening a new account is simple, takes about five minutes, and I was able to do it all in about five minutes. Capital One prepopulates most of your information and you just have to enter in employment title, salary, and check off a few disclosure statements. You can even do it on a weekend (I did it on a Sunday).

Presto – nearly double the APY. It’s not going to be a ton of money but it’s like picking up a quarter on the sidewalk.

Sadly, the Capital One 360 Performance Savings new account promotion has ended. We keep the information below so you know what it used to be, just in case it comes back.

There is, however, a bonus for a 360 Money Market Account – details after the Performance Savings offer information.

CapitalOne 360 Performance Savings — up to

This offer has expired.

There’s a bonus offer on this account too – Capital One is offering up to when you open an account using the promo code BONUS400. The bonus amount is tied to how much you transfer into the account within the first ten days – but this has to be new money to Capital One. You can’t transfer from another account (sorry!). Then, maintain the required daily balance for 90 days and the bonus is deposited in 60 days.

The bonus is based on the deposit amount:

- Deposit $10,000 and get a $100 cash bonus,

- Deposit $20,000 and get a $200 cash bonus,

- Deposit $30,000 and get a $300 cash bonus,

- Deposit $40,000 and get a $400 cash bonus,

- Deposit $50,000 and get a $500 cash bonus (this is the max)

You are only eligible if you haven’t had an open savings or money market account (outside of a CD) as a primary or secondary holder on or after January 1, 2016.

CapitalOne 360 Checking Account — $400

Capital One has a $400 bonus for a new Capital One 360 Checking Account that is super easy to get. Just open an account by 1/26/2021 with the promotion code BONUS400.

Capital One Direct Deposit Form

Then, make 2 direct deposits totaling $1,000 or more within 60 days of opening your account – poof, $400 into your account like magic!

(Offer expired 1/26/2021)

If you can’t meet the direct deposit requirement, there are a few bonuses based on debit card spend too:

Open a checking account by January 26, 2021 and spend at least the amount below to earn the bonus:

- $300 within 90 days – get $100 when open with the promo code BANK100

- $500 within 90 days – get $150 when open with the promo code UPTO250

- $1,500 within 90 days – get $250 when open with the promo code UPTO250

(Offer expires 1/26/2021)

How to Close Your Account Online

Unfortunately, this no longer works. You have to call in.

Capital One Direct Deposit Information

First, log into your account as normal… then visit this link to access the old interface:

https://secure.capitalone360.com/myaccount/banking/account_summary.vm

(copy and paste it in the browser after you log in)

Then click on your account name in the list, followed by “Account Details” tab underneath your Routing Number and Account number. The site defaults to your list of transactions.

Then click on “Close your account” at the bottom:

There’s a confirmation screen but then you’re done:

Alternatively, you can call customer service to close your account. In the past, I’ve had success using the online chat to close an account too.

Capital One Direct Deposit Routing Number

Should You Open This Account?

If you don’t have an existing Capital One 360 Savings account, does it make sense to open a 360 Performance Savings?

Capital One Money Account Direct Deposit

The interest rate is competitive but I don’t feel like there’s a ton of added value with this account. For example, if you open an Ally Bank account, you get a 0.50% APY interest rate plus the ability to link up an Ally Invest account. Ally Invest is a brokerage account that gives you free trades on all U.S. stocks, ETFs, and options. (they also run cash bonuses for new brokerage accounts)

Capital One Direct Banking

SoFi Money is a cash management account that pays 0.25% APY but also has SoFi Invest, another no commission stock brokerage. They’ll also give you up to $100 when you deposit $250 to get $25 then set up a direct deposit of $500 or more to get another $75, no maintenance fee – our full list of SoFi promotions is here.

Capital One Direct Deposit Form

I’ve always been a fan of how convenient it is to open accounts and manage savings goals with Capital One but I’m not sure it’s a good option if you’re opening a new account.