Fixed Deposit Account

Investment Amount

- Fixed Deposit Account Advantages And Disadvantages

- Accounting For Deposits Paid

- Fixed Deposit Account In Us

Grow your money with our Fixed Deposit account. Our competitive interest rate of up to 6% p.a. On your savings will have you reach your goal faster. The interest applies to local and foreign currencies; and will only be accrued if the money remains in the account for the agreed tenor. AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period. Fixed Deposit Account. Guaranteed capital and return on investment. Tenure: Minimum of 30 days, maximum of 180 days. Interest rate and tenure is subject to customer’s preference. Interest with principal can re-invested immediately after the end of the agreed tenure. Interest received is not subject to tax. In deposit terminology, the term Fixed Deposit Account refers to a type of savings account or certificate of deposit where deposits are made for a specified period of time and that pay out a fixed rate of interest. Fixed Deposit Account Example. A Fixed Deposit offers guaranteed returns. Unlike market-led investments where returns fluctuate over time, the returns on an FD are fixed when you open the account. Even if interest rates fall after you open a Fixed Deposit, you will continue to receive the interest decided at the start. FDs are considered much safer than investments in other.

Fixed Deposit Account Advantages And Disadvantages

Minimum – 10,000MMK

Maximum – No Maximum Limit

AYA Time Deposit is ideal for the individual who has excess cash for an extended period of time. The account is opened for a particular fixed period (time) by depositing particular amount (money) and withdrawal is only allowed at the end of the particular period.

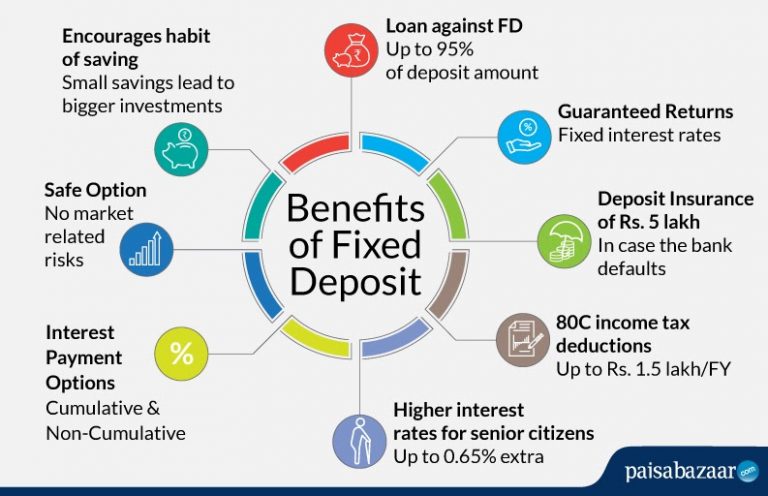

BENEFITS

- Extremely safe

- Higher Interest Rate

- Guaranteed returns

- Fixed Deposit may be pledged to the bank for loans

- Choose the scheme you want

Accounting For Deposits Paid

ELIGIBLITY

Anyone who is Myanmar citizen and over 18 years can open AYA Time Deposit account.

Fixed Deposit Account In Us

- Individual or Joint

- Public Company Limited

- Sole Proprietorship/ Private Company Limited

- Joint venture

- Corporation

- Non Profit Corporation

Keep Your Documents Ready…

Individual

- NRC Number

Corporate

- NRC Number of the authorized person

- BOD Resolution (Meeting minutes)

- Form -6, Form -26, Form E

- Certificate of Incorporation

- Business License

- Memorandum and Articles Of Association

- Export/Import License

INTEREST RATES AND PERIODS

You may choose the convenient period of Time Deposit to gain interest.

- 1 Month Time Deposit – 7.00% P.A

- 3 Months Time Deposit – 7.25% P.A

- 6 Months Time Deposit – 7.50% P.A

- 9 Months Time Deposit – 7.75% P.A

- 12 Months Time Deposit – 8.00% P.A

- 24 Months Time Deposit – 8.50% P.A

The question is inclusive and pertains to both minors (below 18 years of age) and their guardians. Someone who is less than 18 years old but can read and write can open the term deposit account on his/her name. Whereas, minors who can’t read and write will have their guardians on the term deposit account. Now coming to the exact question, let us tell you can open a fixed deposit account at some banks shown below. Let’s read the features of minor term deposit accounts of such banks and figure out the one which is the best of all.

Table of Contents

- 1 List of Banks Offering Minor FD Account

- 2 Documents Required to Open a Minor Fixed Deposit Account

List of Banks Offering Minor FD Account

Bank of Baroda Minor Fixed Deposit Account

Bank of Baroda, one of the largest private sector banks in India, has two fixed deposit accounts for minors –

- Someone with more than 10 years of age (Who can read and write)

- Someone with less than 10 years of age

The first one will be opened in the sole name of minors. On the other hand, the second one will open on a joint basis with natural guardians being the joint account holders. For fixed deposit accounts where a minor is 14 years old or less, the maximum amount accepted is 1,00,000. If the age of a minor is more than 14 years, there shall be no maximum limit. The rate of interest will apply as per the prevailing card rates.

PNB Balika Shiksha Fixed Deposit Scheme

As the name suggests, the said fixed deposit is available for girl students belonging to Scheduled Caste or Scheduled Tribe. All those girls who pass standard eighth from Kasturba Gandhi Balika Vidyalaya and enroll for class IX in schools sponsored by states, union territories or any local bodies in the academic year 2008-09 onwards. The government of India allows a deposit of INR 3,000 for the girl child. Withdrawal is allowed only when the girl becomes 18 years old.

HDFC Bank Kids Advantage Account

It’s actually a savings account that comes with the MoneyMaximizer facility. So once the balance of the account goes past 25,000, the excess amount will sweep out to the fixed deposit account, hence raising the interest earnings.

Canara Bank Minor Fixed Deposit Account

Canara Bank allows fixed deposit accounts for minors with their guardians as the joint holders. The minimum deposit allowed is INR 1,000 and there’s no maximum limit. You can choose the deposit period from as short as 7 days to as long as 10 years. The interest rate will apply as per the prevailing card rate.

Bank of India Minor Fixed Deposits

Bank of India also allows minors to open a fixed deposit account and earn interest on the same. The account will open only when the guardians of minors become joint account holders. The minimum deposit amount is INR 5,000 for accounts opened in rural and semi-urban branches. In case the deposit account is opened in metro and urban branches, the minimum amount should be INR 10,000.

Documents Required to Open a Minor Fixed Deposit Account

- Birth certificate of the minor child

- PAN Card mandatory for guardians who are joint holders of a minor fixed deposit account

- Voter ID/Driving License/Passport/Aadhaar Card for identity proof (Applicable to Minor Guardians)

- Voter ID/Driving License/Passport/Aadhaar Card for address proof (Applicable to Minor Guardians)