Sbi Sb Interest Rate

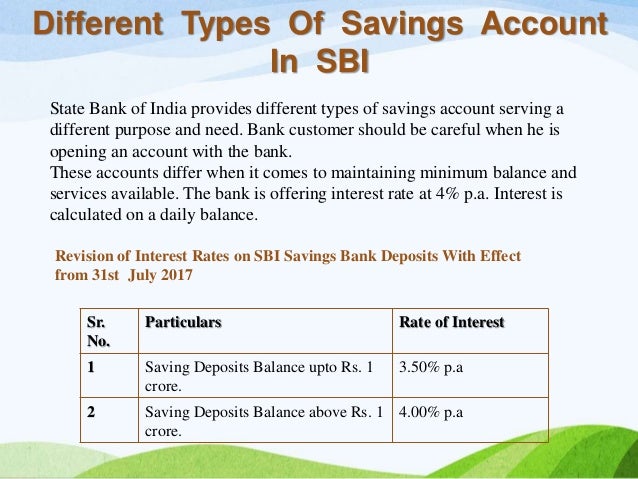

Earlier, the payment of interest in savings bank was controlled by RBI but now RBI has given liberty to commercial banks to pay interest as per their choice. Majority of public sector banks usually pay interest between 3.5% to 4%. Service Charges NRE / NRO account opening procedure Modes of Banking Scope of NRI services - SBI Foreign offices SWIFT Codes Download Forms. The country's largest bank State Bank of India (SBI) and second largest private sector lender ICICI Bank have reduced interest rates on savings bank deposits by 5 basis points and 25 basis points, respectively. SBI has reduced its savings deposit interest rates to 2.70 per cent across all slabs from May 31, according to its website. Loan Schemes - Interest Rates Marginal Cost of fund based lending rate Interest Rate For Borrowers Other Than P Segment - Commercial Loans SME Interest Range SMEBU 10 years interest rate Interest Rates On Pre Shipment Credit And Export Bill Discounting in Foreign Currency Loans Interest Rates. 1) SBI has trimmed the interest rates on savings bank accounts up to ₹ 1 lakh by 25 basis points. SBI savings accounts will fetch an interest rate of 3.25% instead of 3.5%. India's largest.

A view of State Bank of India (SBI) bank branch and ATM in Bangalore, India. (file photo, source: Bloomberg)

India’s largest public-sector lender State Bank of India (SBI) on Wednesday scrapped the minimum balance requirement on all savings bank accounts.

This apart, the bank also rationalised interest rate on all savings bank accounts to a flat 3 per cent. The move is likely to impact around 44.51 crore account holders of the public sector lender.

Along with these measures, SBI said that it has also waived SMS charges, which will provide a significant relief to all its customers.

“Bank has also rationalised interest rate on SB Account to a flat 3 % p.a. for all buckets,” SBI said in a statement.

Till now, the interest rate on savings accounts was 3.25 per cent for deposits up to Rs 1 lakh, and 3 per cent for deposits above Rs 1 lakh.

“The charges on maintaining AMB (Average Monthly Balance) are now waived off on all 44.51 crore SBI savings bank accounts,” the bank said.

Customers of SBI had to maintain an average monthly balance of Rs 3,000, Rs 2,000 and Rs 1,000 in metro, semi-urban and rural areas respectively, failing which they used to levy a penalty of Rs 5 to Rs 15 plus taxes.

Earlier in the day, the bank also announced that it has reduced its marginal cost of fund-based lending rate (MCLR) by up to 15 basis points across various tenors, effective March 10.

(with PTI inputs)

Business News, Nation, (New Delhi), March 12:-The State Bank of India (SBI) on Wednesday cut interest on savings bank accounts to 3 percent and also waived its minimum balance requirement as it set the trend of lowering interest rates in the banking sector. The country’s largest lender has 44.51 crore savings bank (SB) accounts.

More banks are likely to follow to the market leader in slashing interest rate on SB accounts and waiving minimum balance requirements.

Earlier in the day, SBI reduced its fixed deposit rates and marginal cost of funds-based lending rates (MCLR) for various tenors.

Keeping in mind the ‘Customers First’ approach, the bank said it has also waived SMS charges, which will bring significant relief to all the customers.

“Bank has also rationalised interest rate on SB Account to a flat 3 percent per annum for all buckets,” it said in a statement.

Currently, the interest rate on SB accounts is 3.25 percent for deposits up to Rs 1 lakh in SB accounts and 3 percent for deposits above Rs 1 lakh.

SBI said it has decided to waive maintenance of Average Monthly Balance (AMB) for all SB accounts. “The charges on maintaining AMB are now waived off on all 44.51 crore SBI savings bank accounts,” it said.

Currently, SBI customers need to maintain AMB of Rs 3,000, Rs 2,000 and Rs 1,000 in metro, semi urban and rural areas, respectively. The bank used to levy a penalty of Rs 5 to Rs 15 plus taxes on non-maintenance of AMB.

SBI had introduced penalty on breach of minimum balance in SB accounts in April 2017 after 2012. However, later in October it slashed the penalty amount.

Making it the second reduction in as many months, the public sector bank reduced interest rates for retail term deposits (less than Rs 2 crore) by 10 to 50 basis points for a few tenors.

Fixed deposits (FDs) maturing between seven to 45 days will offer an interest rate of 4 percent as against 4.50 percent earlier. Interest rates on FDs maturing in a year and above have been reduced by 10 basis points.

One-year to less than two-year tenor FD will earn an interest rate of 5.90 percent against 6 percent earlier. FD for similar tenor will fetch an interest rate of 6.40 percent instead of 6.50 percent for senior citizens.

The bank has also reduced interest rates on bulk term deposits (Rs 2 crore and above) by 15 basis points for 180 days and above tenors.

FD rates in the bulk category for tenor of one-year and above will earn 4.60 percent instead of 4.75 percent.

In February, the bank had slashed term deposits rates by 10-50 basis points in the retail segment and 25-50 basis points in the bulk segment. Further, the one-year MCLR has been reduced by 10 basis points to 7.75 percent from 7.85 percent earlier, the bank said.

This is the 10th consecutive cut in MCLR by the bank in the current fiscal.

Private sector lender ICICI Bank on its website said the savings account interest rate is 3.5 percentfor end of day account balance of below Rs 50 lakh, and 4 percent for balance of Rs 50 lakh and above.

Several private sector lenders have minimum balance requirement of at least Rs 10,000.

Sbi Sb Interest Rate

-(NAV, Inputs: Agencies)

Sbi Sb Account Interest Rate

Leave a Reply

Sbi Bank Interest Rate

comments